The shipping industry plays a critical role in world economics. Its immense power stems from its ubiquity–in every sector, you will find shipping and a supply chain. An essential component of the shipping industry is trucking, which many companies and industries prefer because of its low cost, refrigeration potential, and fast delivery time. Today’s driver shortage is helping to drive transportation costs higher.

With the rising economy, setbacks in trucking have occurred. Most notably, earlier this year when freight volumes hit records levels while at the same time, the number of available drivers fell by more than 50,000. This confluence caused a problem that persists today.

How to Manage Transportation Costs with Real-Time Visibility & Analytics

As Freight Volumes Rise, Driver Shortage Grows

Shipping industry members are scratching their heads, wondering how to solve this complex and incredibly significant problem. To put this in perspective, 2018 is the first year since 2006 in which driver shortage is the primary concern of the industry.

Along with a shortage of drivers, and arguably more important is the leaping increase in demand in recent months. This demand spike coincided with a huge increase in driver turnover. Some sources recorded up to a 20 percent annual demand increase for large truckload carriers and fleets. As demand continues to climb, finding enough drivers to fulfill shipments remains a huge challenge for the industry.

Slow and unpredictable shipping has a domino effect that can grind optimized, just-in-time supply chains to a halt. Numerous aspects involving shipping information create longer wait times at plants and distribution centers. Inclement weather, rising oil prices, and clogged roads all heavily affect arrival and delivery times. On top of all these factors, the driver shortages, an almost 100% driver turnover rate, and increased demand further jam up the supply chain and limit transportation options.

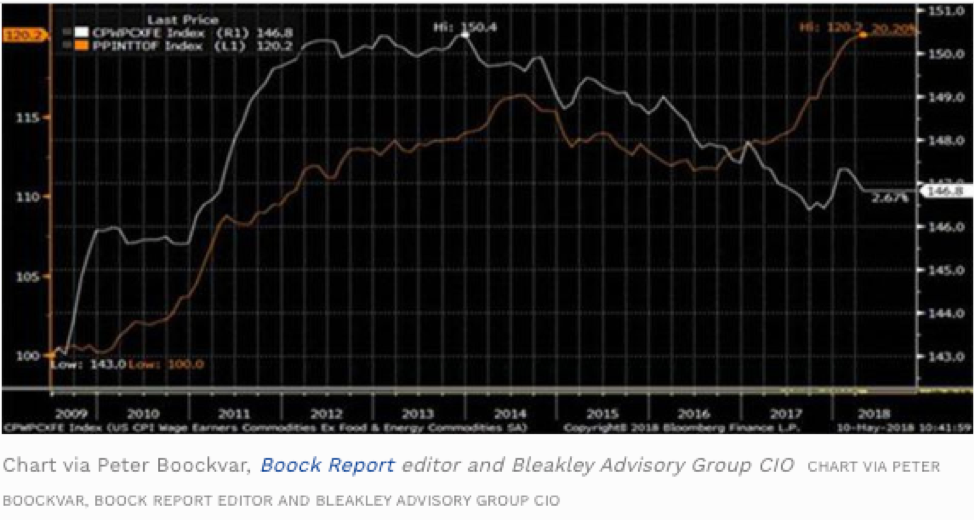

The chart below (courtesy of Peter Boockvar) illustrates historical truck transport cost and consumer goods cost movement.

The orange line is the trucking cost component of the Producer Price Index. The white line is consumer goods, minus food and energy. As the chart indicates, truck transport costs rose sharply in 2017 and aren’t slowing down.

Trucking Costs vs. Consumer Goods Costs (Minus Food and Energy)

With rising shipping costs, companies are struggling to balance competing priorities: keeping their supply chains moving quickly while protecting profit margins. One contributing factor is that over the past decade, truck transport costs have risen over seven times faster than product prices. This grim reality challenges companies to find new approaches to make their supply chains as efficient and cost-effective as possible.

In-transit visibility and prescriptive analytics can help transform a supply chain by giving operations teams end-to-end in-transit visibility and identifying opportunities for optimization. For example, supply chain managers can find the most timely carrier by lane, see which routes are more high-risk for theft or tampering, or which distribution centers have the most efficient cross-docking.

Combine multiple data streams, from sensors, EDI and other sources, with machine intelligence and proprietary algorithms to create actionable insights for optimization. A platform that delivers alerts to supply chain managers on route disruptions or delay can save time and reduce risk. These benefits are particularly useful during an economic upswing since they can help shippers more easily meet deadlines and tighten inventories without understocking.

Changes in the Economy

Based on current macroeconomic trends, it is evident there is strong quarterly growth occurring over the last year–all trends in the general economy are pointing in a positive direction. With recent increases in consumer spending and business investments, rising inventories across a multitude of industries are a must.

Compared to numbers in 2015 and 2016, 2018 so far has shown significantly higher numbers in all areas. There is a record low for the unemployment rate in the United States, and although this trend is seemingly positive, there is a growing difficulty in terms of retention rate for drivers in the shipping industry.

What Contributes to High Driver Turnover?

Drivers are retiring and switching to other occupations, making it more difficult to cope with the increase in demand this year. This lowering retention rate is a result of drivers’ tendency to low pay, early retirement ages, and frustrations with the new ELD Mandate.

One area plaguing the trucking industry is the low wages drivers receive for their services. Historically and most frequently, drivers are paid by mileage, largely because EDI and other technology up to this point have provided an ability for drivers to skirt regulations or alter the tracking of a shipment. Now with end-to-end visibility in supply chain tracking, paying drivers by the hour is feasible and more appealing to those in the industry.

Inventories in industries are rising significantly as a result of the economic upswing, causing sales to also rise. The strong economy, however, has caused the relationship between inventories and sales to fall. Additionally, inventories’ turnover rates have increased steadily, which places a lot of pressure on transportation companies to tighten and meet deadlines, and pressure on companies to fill inventories more quickly than ever. The increased tightness and capacity, as well as the unusually high demand for the season, both contribute to tension in the transportation industry.

ELD Mandate’s Impact on Transportation

Along with increased demand, tightened inventory turnover rates and an economic upswing, one of the largest changes the shipping industry is currently facing is the recently instated Electronic Logging Device (ELD) Mandate. This mandate requires all drivers to use an ELD to record Hours of Service (HOS) and Record of Duty Status (RODS). While the stated purpose is to help prevent accidents due to fatigue, it adds to overall shipping cost.

The reduction of paperwork the mandate is attempting to implement is moving the shipping industry to a more electronic and automatic status. The mandate further reduces available truck capacity because it prevents HOS over the allotted amount.

Thus, companies are attempting to spread out orders to avoid overloading. At the same time, drivers are becoming more sensitive about the type of goods they choose to transport, and companies are becoming pickier about the types of goods they ship. So far, the new ELD Mandate has had negative impacts on the shipping industry.

Warehouse Supply and Availability

Warehouse space is at the same time much harder to come by, as it is at its tightest capacity in almost 20 years. A strong economy contributes greatly to this trend, as consumers are buying more items, and bigger items, while pulling down available space for other goods.

Consumers’ love for online shopping has also contributed to an enormous deduction of warehouse space. In response, many distribution centers have either added more operations or switched to a cross-docking approach, in which they borrow other facilities’ space for specific areas of transportation throughout the supply chain.

Short-Term and Long-Term Solutions for Resolving Driver Shortage Challenges

The lack of experienced drivers contributes to the current market problem for the shipping industry. With long and irregular hours, along with lifestyle issues, low pay, and regulatory challenges, it is difficult to maintain the number, let alone increase, the number of available, experienced drivers.

Companies are having to increase salaries for current drivers to keep them in the workforce. Trucking fleets are attempting to add capacity, but it could take months or even years to bring those numbers up to fit the current demand level in the industry. It’s clear there is an urgent need to expand the fleet capacity and maintain current drivers for commercial shipments.

With in-transit visibility solution, it is possible to use current qualified drivers more efficiently and effectively. For instance, the capability to see when a shipment is trending early allows planners to alert an operations team at the cross-docking facility so they can have resources available to unload/load goods.

More efficient operations mean drivers don’t sit idle waiting for hours. Knowing precisely where all your shipments are en route allow for planners to make adjustments as quickly as possible and avoid disruption. Savi’s technology gives companies the tools needed to effectively monitor and optimize supply chains based on historical data and analysis of all shipments.

Short-term solutions include postponing delivery, switching brokers, finding different carriers and paying more money, none of which pose a real and durable solution.

Additionally, some shippers are considering switching modes—using railroads instead of trucks. While shipping via rail generally takes a significantly longer time than a truck, as capacity tightens and driver shortage and demand both grow, the time spent waiting for an available carrier brings the time it takes for railroad almost equal to the time it takes for a truck.

Long-term solutions include adopting analytics and in-transit visibility technologies to easily identify where you can make your supply chains more efficient. Yes, in the short term turning to rail or seeking quick fixes may decrease shipping time, but ultimately the problem will persist. Whereas with end-to-end visibility and beneficial data analytics powered by machine intelligence, shippers see when docks are available, and identify and resolve the parts of the supply chain that are not working efficiently.

Companies can utilize other long-term solutions, such as driver-friendly focus and dedicated fleets, to avoid the big swings of labor capacity issues. A driver-friendly focus affects the timeliness of a pickup or delivery since this approach works with drivers’ schedules to ensure the most efficient transit route. Dedicated fleets can prevent wait times for available drivers, potentially cutting transit time. Savi Insight can help shippers schedule open loading docks, allowing drivers to avoid spending hours waiting at pickup or delivery locations for a dock to clear.

New Tariffs and Rising Costs this Year

Also affecting the overall economy and more specifically the economy of the shipping industry are the 2018 international trade tariffs introduced this year. Under these tariffs, costs of shipping for certain materials have increased.

In light of these changes, true end-to-end visibility becomes more important than ever for organizations seeking a competitive edge. Rising costs can negatively impact entire companies and industries, but with the ability to clearly see the complete supply chain ecosystem, manufacturers and shippers can reduce safely stock, thus freeing up money for other priorities.

Market Outlook and Strategies

Ultimately, the continued strength in the market for the remainder of 2018 suggests trucking capacity will stay close to full for the rest of the year. This capacity is slowly expanding, which means shippers must think more strategically about transportation planning. The issues the industry is currently facing are not cyclical in nature; rather, they necessitate long-term, creative solutions that will solve the problems instead of kicking the can down the road.

With these trends in mind, visibility of transportation becomes vital for better planning for future shipments. Savi solutions can help shippers maintain end-to-end visibility and gather relevant data for important analysis to inform future shipments.

Smart organizations will take what began as a challenge and turn their response to high transportation cost and driver shortage to their advantage. By implementing a live streaming supply chain visibility solution now, shippers can better navigate high demand and low supply, as well as limited warehouse availability and rising inventory turnover rates.